Contents:

When an increasing %K line crosses above the %D line in an oversold region, it is generating a buy signal. You can wait for a bar to close to confirm the stochastic crossover and then look for further confirmation with price action analysis and other indicators. The stochastic crossover is popular strategy used by forex traders.

When %K line from below crosses %D line upwards traders open Buy orders. AximDaily is considered a marketing publication and does not constitute investment advice or research. Its content represents the general views of our editors and does not consider individual readers’ personal circumstances, investment experience, or current financial situation. The Stochastic oscillator measures the change in prices based on a scale from one closing period to the next in order to predict whether a trend will continue into the next.

Forex Trading Strategies Installation Instructions

When price makes a lower low, but the stochastic oscillator fails to confirm and instead makes a higher low, this is considered a Bullish Stochastic Divergence signal. When price makes a higher high, but the stochastic oscillator fails to confirm and instead make a lower high, this is considered a Bearish Stochastic Divergence signal. Such conditions are known as a trend reversal divergence signal. While the overbought and oversold signals generated by the Stochastic Oscillator is quite reliable, it is worth noting that these signals work best during a range bound market. George Lane used to refer to these types of occurrences as the “Stochastic Pop”. It is recommended that you double check the stochastic oscillator settings on your favorite charting platform to confirm the number of periods it is using.

WTI Crude Oil Forecast: Continues to Chop Back and Forth – DailyForex.com

WTI Crude Oil Forecast: Continues to Chop Back and Forth.

Posted: Fri, 24 Feb 2023 10:30:57 GMT [source]

The Stochastic oscillator is another technical indicator that helps traders determine where a trend might be ending. One approach to using Stochastic Oscillator trend continuation or hidden divergence signal is by combining it with the crossover signal. When the market generates a hidden divergence signal, and a Stochastic Oscillator crossover happens, the combination of these two can produce a high probability setup. As you can see in figure 5, as soon as the %K line crossed over the %D line, the GBPUSD price ended the retracement and resumed the uptrend.

Beispiel für einen Sell Einstieg

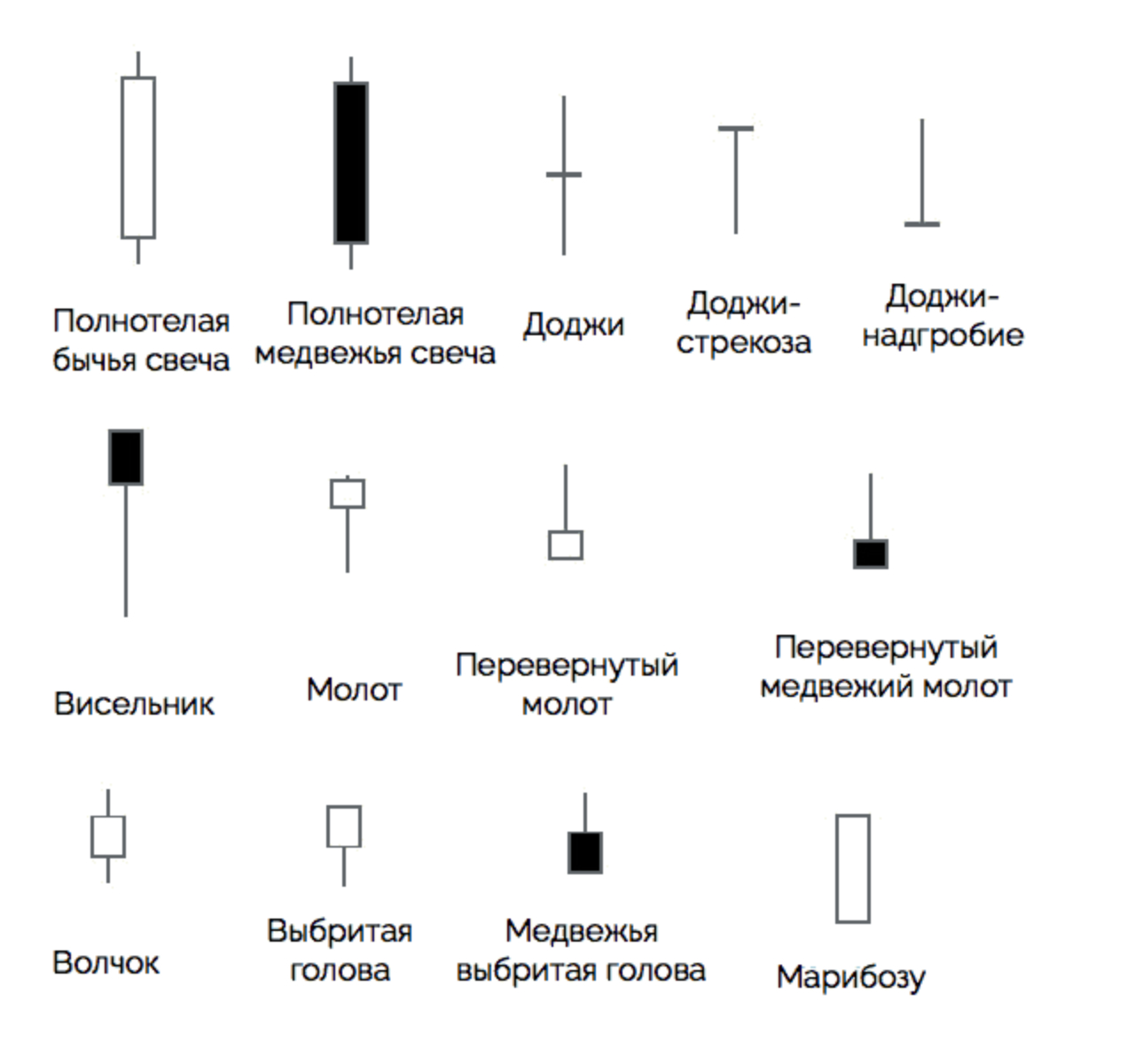

We will combine all of the different elements of the Bollinger bands and stochastic together so we only take trades when they all agree. This can give our strategy that extra edge and help to filter some false signals. We will also look at how price is reacting to key price levels to time our entry. The 200 Ema indicator helps detect the trend, and the stochastic indicator is useful for measuring how strong the trend is. Since two indicators are used, it is safer to purchase or sell Forex. For additional checking before placing forex trading orders, candlesticks for forex reversal can be used to confirm the right point to enter a forex trade.

Stochastics is one of the most popular indicators used by day traders because it reduces the possibility of entering a position based on a false signal. Fast stochastics are like speedboats, agile, and able to change directions quickly based on market movement. When used with caution, stochastic oscillators can be powerful trading tools.

If your stochastic oscillator trading strategy relies on frequent alerts, use the settings. If you prioritize the signs’ reliability, and parameters are ideal. The U.S. dollar often continues moving following the momentum when curves enter overbought or oversold zones. Therefore, you should enter the market when there is a price reversal. The stochastic Forex strategy isn’t useful for USD if it’s based on fixing overbought conditions during an uptrend and oversold ones during a downtrend.

TMA Slope Alerts Indicator for MT4

We can enter the market at the opening of the next candle after the signaling one. Below, we’ll look at stochastic trading features on the S&P 500 futures, gold, and the U.S. dollar. In the chart above, this situation is marked with a red oval. Man that was well explained in such few lines, I looked the explanation somewhere else and so far yours is short and well presented. The difference between Full and other Stochastic lies in the second parameter, which is made to add smoothing qualities for %K line. Applying this smoothing factor allows Full Stochastic be a bit more flexible for chart analysis.

- The essence of this forex strategy is to transform the accumulated history data and trading signals.

- The Stochastic oscillator is another technical indicator that helps traders determine where a trend might be ending.

- Most beginner Forex traders get confused about how to correctly interpret the Stochastic Oscillator signals under varying market conditions.

- They are included in the classic technical analysis and remain popular among plenty of traders.

Our objective is to facilitate you in developing your trading. The 15-minute chart is our recommended time frame for the Best Stochastic Trading Strategy. This strategy is very attractive, but any MA – which I try – not crossover 80/20%. I’d believe that for your purposes you can use the same set of indicators, among which I would try MACD, Stochastic, then possibly also Parabolic SAR and some Moving averages. As an example, Forex traders can use 34, 5, 5 and 5, 3, 3 Stochastics together. The first parameter is used to calculate %K line, while the last parameter represents the number of periods to define %D – signaling line.

However, in the below chart, I also “slowered” the %D period and Slowing. It means the middle Stochastic Oscillator settings is 10, 6, 6 and the lower one is 20, 12, 12. The Keltner Channel or KC is a technical indicator that consists of volatility-based bands set above and below a moving average. The lower you set the stochastic settings, the more signals you will get. However, you may find that this causes a lot of false signals. If you increase the period, the stochastic signals will be less frequent but could be more reliable.

The USDJPY awaits more rise – Analysis – 01-03-2023 – Economies.com

The USDJPY awaits more rise – Analysis – 01-03-2023.

Posted: Wed, 01 Mar 2023 04:47:09 GMT [source]

You should now be more familiar with the Stochastic Oscillator and understand why it is such a popular indicator in Forex trading. The Stochastic Oscillator trading strategies that we have explored above can also be a unique way to look into the markets. The Stochastic Oscillator was developed in the 1950s and, due to its versatile nature, remains one of the most popular technical indicators used in Forex and stock trading today.

You can also wait for the https://traderoom.info/ line to rise above 20 for more affirmative signals. An overbought sell signal is given when the oscillator is above 80, and the solid blue line crosses the red dotted line, while still above 80. Conversely, an oversold buy signal is given when the oscillator is below 20, and the solid blue line crosses the dotted red line, while still below 20. The time periods referred to are the standard periods used, however, this can be changed for different needs in the settings of the indicator – as seen in the image of the settings above.

When using the https://forexhero.info/ s forex indicator, it is important to remember that, as with any technical indicator, a Stochastics chart will never be 100% correct in the signals that it presents. Depending on market conditions, indicators will sometimes present traders with false signals. Over time, however, the signals are usually consistent enough to give a forex trader an edge, when it comes to making profitable trades. This also can allow the indicator to provide built-in closing logic, as the contra signal would be to close the position.

The best stochastic oscillator settings for М5, М15, М30, and, sometimes, H1 timeframes are , , or . On high timeframes, such parameters may generate false signals. Therefore, stochastic oscillator settings for H4, D1, and, sometimes, H1 charts are , or .

It broke out above a 2-month trendline and pulled back , triggering a bullish crossover at the midpoint of the panel. The subsequent rally reversed at 44, yielding a pullback that finds support at the 50-day EMA , triggering a third bullish turn above the oversold line. The Stochastics oscillator, developed by George Lane in the 1950s, tracks the evolution of buying and selling pressure, identifying cycle turns that alternate power between bulls and bears. Fewtraders take advantage of this predictive tool because they don’t understand how best to combine specific strategies and holding periods. It’s an easy fix, as you will see in this quick primer on Stochastics settings and interpretation.

- Follow these three simple rules, and you will be surprised by the result.

- It’s highly recommended to implement the stochastic oscillator with other trend indicators.

- The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.

The https://forexdelta.net/ indicator identifies when the price is moving upward or downward and how strongly. Momentum measures the rate of change in prices as opposed to the actual price changes… If the blue line of the Stochastic crosses the red line to the downside and from inside the area above the 80.00 level.