Contents

In this case, if the market trend changes, your position will be closed if the price hits the trailing stop loss level. It is an instruction to your Forex broker to sell the specified currency pair once the price hits the pre-set price, which is lower than the current market price. Amongst our various businesses, we are a stock brokerage company which services clients across the country and assists them in their investment decisions. It is under the regulatory oversight of SEBI as well as NSE and BSE which on a routine and ongoing basis audit our performance, books of account and other particulars. A recent routine inspection in August 2019 was carried out by SEBI, the Exchanges and the depositories.

The general idea of using SwingArms is to provide a visual confirmation of a trend change. Green for bullish Red for bearish A color-coded system providing an easy way for a novice to understand. Converted to TradingView based on the work of Jose Azcarate. There are no separate charges of using a trailing stop loss in your trades. The owners of the website and the website hereby waive any liability whatsoever due to the use of the website and/or information. Use of the website, the content and the information is made on the user’s sole liability.

Just like a stop loss order, a take profit order is subject to potential positive or negative slippage. Here you will also learn how to calculate the pip value of any currency pair in the specific currency in which your trading account is denominated, for example, the U.S. dollar. Forex traders who carefully manage their risk and use acceptable amounts of leverage are unlikely to suffer notable losses due to price gaps that breach their stop loss orders. If the security price rises or falls in your favour, the trigger price jumps with it at the set value or percentage. A very important part of stop-loss orders is Trigger Price. This refers to the desired price at which you want your order to be executed.

Contrary to a regular stop loss, a trailing stop loss moves according to changes in price levels of a financial instrument. Market order is a client’s command to buy or sell a financial instrument at the current market price. The transaction is performed instantly via the trading platform https://1investing.in/ and at the price shown in the market order window or via telephone at the price quoted by the dealer. The first steps in risk management are to use the correct lot size, risk a small amount of capital per trade, avoid overtrading, and apply high-probability trading strategies.

Trailing Stop Loss

1) Suppose you select ticks then you are required to mention 40(2/0.05) in sell orders. This means, every rupees increase in price consists of 20 ticks. Bracket orders make sure that your profit or loss lie between two limits of an acceptable profit and bearable loss that you set. Trailing stop loss orders are established to function automatically with stockbrokers and their investing software. In the trading platform NetTradeX Trailing Stop is a server-side mode which remains active even when the client’s terminal is turned off.

Kindly don’t trust such kinds of messages from any unauthorized persons. ApplyStop function by default requires us to provide stop amount . Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. Loss stop at much smaller percentage (such as 10% or 20%) depending on what your risk tolerance is, to limit drawdowns and decrease the chance of wiping your account down to zero.

Technical indicators can be used to put in a trailing stop loss. Stop Loss order is executed at a price set by the client, except the cases of price gaps, when the order may be executed at the first price available in the market. You see, if you use really tight stops with extremely wide targets, you could have a very jagged equity curve, with drawdowns beyond your comfort zone. You also stand a good chance of losing money with this type of trading. When you place a stop loss, you need to be reasonable and consider the ratio between your stop loss and take profit.

Is 5% a good trailing stop-loss?

A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%

Hence we are currently unable to offer it for those plans. In case you wish to avail bracket orders, we’d request you to kindly change your pricing plan to the 0.7p or Rs 15 plan. We will also explore other opportunities where the unlimited trading plan can also offer the same but it might take some time. When traders are convinced that they’ll only incur a certain percentage of loss in case the price of a financial instrument drops. Nevertheless, when the market price rises, they’ll be able to benefit from the gains while having precaution against heavy losses.

Using price levels with ApplyStop function

Stop-loss is a tool that investors use to minimise the loss in a trade. Some traders define it as an advance order, which triggers an automatic closure of an open position when the stock price reaches the trigger price level. I’m a newbie and with my paper trades I’ve just been setting up regular stop losses. I can start incorporating the trailing stop loss, so I can practice some swing trading. I’ve heard of trailing stop losses, but wasn’t exactly sure how to implement it.

But if you’re planning on keeping trades overnight, you may incur rollover charges, depending on which pairs you trade. With some pairs, you will actually earn interest when you hold them overnight. If you choose to only trade currency pairs with very low spreads , you will surely miss out on superb trading opportunities from time to time. Nevertheless, there are successful traders who focus only on major pairs. The trading approach you follow will influence your choice of currency pairs.

With the GBP/JPY, the average range of a 1-minute candlestick is about 3.5 pips. So, you could easily cover your trading costs in less than a minute if the price moves in your favour. Of course, we’re not considering rollover fees in this example.

- A stop loss order helps you exit a position as soon as the stock hits that bottom of loss.

- Let’s say that an investor, Mr B buys 200 shares of ABC Company at Rs 50 each.

- There is no guarantee that you will receive the price of your stop-loss order.

- Of course, there is money to be made with counter-trend trading, but it requires a lot of skill and mostly exposes you to more risk and smaller rewards.

It is an intraday order which can not be converted into delivery. However stupidly simple that may sound, that’s what it actually is. Even though Mr B expects the share price of ABC Company to rise, some unfavourable conditions might lead to the opposite. In that case, the trailing sl would allow him to limit his losses to 10% of the initial investment. While you trade in the markets, you always trade with reduced capital. That means; your primary aim must be to keep your capital from reducing beyond a point.

If not for all scripts this can be utilized for specific scripts or for Index. You can set trailing stop loss in Ticks or Absolute as per your convenience. That is how a bracket order works in online trading software, the moment one order among the Stop-loss or the target order is executed, the other is automatically cancelled.

Making a trailing stop with StopMarketOrder()?

You are now leaving the TD Ameritrade Web site and will enter an unaffiliated third-party website to access its products and its posted services. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session. If your position continues to move higher, your trailing stop also moves higher.

What is the best stop loss in forex?

The percentage stop

Many traders are advised to risk a maximum of 2% on each trade in order to protect their trading capital. This means that the trader never exceeds the 2% mark when placing the stop-loss regardless of market conditions, which is a good way to protect your trading.

To be honest, I didnt follow everything you mentioned in your explanation about this indicator but what I understood is to keep Kijun value 3 candles back from its current reading. Also, CAPEX.com WebTrader provides extra trading tools such as price alerts. These features help you to monitor the markets without having to always stare at your charts. It in no way prevents us from continuing Pv Of An Annuity Tables to transact business on behalf of our existing clients as per their instructions, and in furtherance of investor best interests. The restriction on onboarding new clients is only for a twenty one day period subject to us submitting the clarifications and stating our position. Please note that, the Bracket Order feature is available for .7 paise and Rs. 15 per executed order trading plans.

Indicators, Strategies and Libraries

We hope this article has answered your queries regarding Stop-loss orders, and now that you know how to place Stop loss orders with Angel One. If the LTP increases to ₹110, a Buy Market Order will be executed at market price. If the LTP of ‘X’ falls to ₹90, a Sell Market Order is sent, and your position gets squared off at market price. In this case, when the security price reaches the trigger price, the Stop-loss Order gets converted into a Limit Order.

When the security price reaches the trigger price, the stop-loss order is activated. So, in that situation, it would be wise not to use 30 pips stop loss . In order to give the trade some room to work out try not to go for too tight stop loss, like pips or not too wide as well. Otherwise, the trade will not work out the way it should be and with a too wide stop loss; you may risk losing too much. Giving the ‘room to breathe’ is important but not when the trade is already going against you.

Without profits, services suffer and we strongly believe profits are the lifeline of any sustainable business. I am utterly disappointed for not including this under unlimited trading plan and i do not want this happen to new customers. Yes, bracket orders can be used to trade in Nifty options as well. The function of trailing ticks remains the same for all cases. One is a normal stop loss order where your lot will be sold automatically once the exchange hits a bottom line that you set .

What type of stop loss is best?

A wide stop-loss tends to work best for swing trading, or mid-to-long-term trades, as the trade has more time to move in your favour before the stop-loss is hit. A tight stop-loss is better suited for day trading or short-term trades, as the trade has less time to move in your favour before the stop-loss is hit.

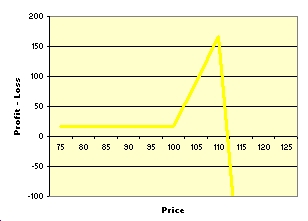

Upon submission of the preliminary inspection report by NSE to SEBI, the regulator issued an ex-parte ad-interim order dated 22-Nov-2019 issuing directives in investor interest. The nature of this order is such that by definition, it is an ‘interim’ directive and not a final finding. The order itself states emphatically, that this is in response to preliminary findings and is subject to further review upon a more comprehensive audit and investigation. OPTION STRATEGIES Options allow the investor to sculpt the returns in their portfolio. When you buy a stock and the price rises $1, you make $1. Your profits are linear and directly related to only the change in the price of the stock.

Before trading, you should carefully consider your investment objectives, experience, and risk appetite. Like any investment, there is a possibility that you could sustain losses of some or all of your investment whilst trading. You should seek independent advice before trading if you have any doubts. Past performance in the markets is not a reliable indicator of future performance.

In most cases, the best design is to use trailing stop loss along with stop loss. Is placed, which is usually a percentage, that creates a moving or trailing stop price. You can lose the ability to make a thoughtful and analytical decision on whether to sell the stock when the price drops.